What Are Retained Earnings? Formula, Examples and More

However, it differs from this conceptually because it’s considered to be earned rather than invested. The normal balance in a profitable corporation’s Retained Earnings account is a credit balance. This is logical since the revenue accounts have credit balances and expense accounts have debit balances.

For larger, more complex companies, this will be all units sold across all product lines. A maturing company may not have many options or high-return projects for which to use the surplus cash, and it may prefer handing out dividends. The decision to retain the earnings or to distribute them among shareholders is usually left to the company management. However, it can be challenged by the shareholders through a majority vote because they are the real owners of the company. Retained earnings is the cumulative amount of earnings since the corporation was formed minus the cumulative amount of dividends that were declared.

What Is the Difference Between Retained Earnings and Dividends?

Factors such as an increase or decrease in net income and incurrence of net loss will pave the way to either business profitability or deficit. The Retained Earnings account can be negative due to large, cumulative net losses. Retained earnings is the residual value of a company after its expenses have been paid and dividends issued to shareholders.

This number is found on the company’s balance sheet and tells you how much money the company started with at the beginning of the period. Accountants must accurately calculate and track retained earnings because it provides insight into a company’s financial performance over time. Accurate calculations can help the company make informed business decisions and ensure that profits get reinvested to benefit the company. While they may seem similar, it is crucial to understand that retained earnings are not the same as cash flow. Retained earnings represent the profits a business generates over time, while cash flow measures the net amount of cash/cash equivalents coming and and out over a given period of time.

How Net Income Impacts Retained Earnings

However, it can be affected by a company’s ability to competitively price products and manufacture its offerings. Retained earnings are a portion of a company’s profit that is held or retained from net income at the end of a reporting period and saved for future use as shareholder’s equity. Retained earnings are also the key component of shareholder’s equity that helps a company determine its book value.

- Retained earnings are the portion of a company’s net income that is not paid out as dividends.

- Every finance department knows how tedious building a budget and forecast can be.

- Net income is often called the bottom line since it sits at the bottom of the income statement and provides detail on a company’s earnings after all expenses have been paid.

- However, it is more difficult to interpret a company with high retained earnings.

- Retained earnings, on the other hand, are reported as a rolling total from the inception of the company.

- Any item that impacts net income (or net loss) will impact the retained earnings.

As the company loses ownership of its liquid assets in the form of cash dividends, it reduces the company’s asset value on the balance sheet, thereby impacting RE. Retained earnings are reported in the shareholders’ equity section of the corporation’s balance sheet. Corporations with net accumulated losses may refer to negative https://accounting-services.net/bookkeeping-lancaster/ shareholders’ equity as positive shareholders’ deficit. A report of the movements in retained earnings are presented along with other comprehensive income and changes in share capital in the statement of changes in equity. Finally, if the balance of retained earnings is growing over time that might not be a good thing.

How to cut down busy work to meet your small business goals

By calculating retained earnings, companies can get a snapshot of their financial health and make decisions accordingly. Finding your company’s net income for the period in question is essential to understanding its retained earnings. If you use retained earnings for expansion, you’ll need to determine a budget and stick to it. Doing so will ensure that your company uses its earnings efficiently and maintains the right balance between growth and profitability. This financial metric is just as important as net income, and it’s essential to understand what it is and how to calculate it.

How to calculate retained earnings?

To calculate retained earnings add net income to or subtract any net losses from beginning retained earnings and subtracting any dividends paid to shareholders.

On the balance sheet, the retained earnings value can fluctuate from accumulation or use over many quarters or years. Revenue on the income statement is often a focus for many stakeholders, but the impact of a company’s revenues affects the balance sheet. If the company makes cash sales, a company’s balance sheet reflects higher cash balances. Companies that invoice their sales for payment at a later date will report this revenue as accounts receivable. On one hand, high retained earnings could indicate financial strength since it demonstrates a track record of profitability in previous years. On the other hand, it could be indicative of a company that should consider paying more dividends to its shareholders.

Age of the Business

It’s also a key component in calculating a company’s book value, which many use to compare the market value of a company to its book value. Datarails’ FP&A software replaces spreadsheets with real-time data and integrates fragmented workbooks and data sources into one centralized location. This allows FP&A analysts to work in the comfort of Microsoft Excel with the support of a much more sophisticated data management system at their disposal. Finally, it can be used to satisfy both long and short-term debt obligations of the business. There are a variety of ways in which management, and analysts, view retained earnings.

You can find this number by subtracting your company’s total expenses from its total revenue for the period. It tells you how much profit the company has made or lost within the established date range. If a company has negative retained earnings, its liabilities exceed its assets.

How do retained earnings affect a small business’ financial statements?

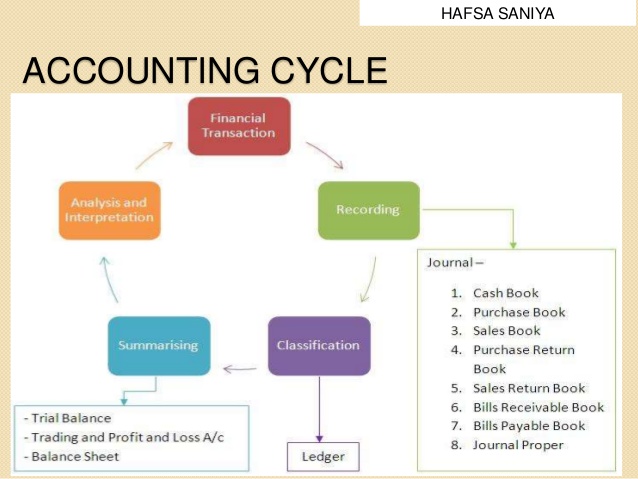

The net income contributes to retained earnings but, as mentioned, retained earnings are cumulative across accounting periods, subject to dividends being taken out, and accounted for as an asset. At the end of an accounting year, the balances in a corporation’s revenue, gain, expense, and loss accounts are used to compute the year’s net income. When the year’s What Are Retained Earnings? revenues and gains exceed the expenses and losses, the corporation will have a positive net income which causes the balance in the Retained Earnings account to increase. The accountant will also consider any changes in the company’s net assets that are not included in profits or losses (i.e., adjustments for depreciation and other non-cash items).

In this case, the company would need to take action to improve its financial position. Some companies use their retained earnings to repurchase shares of stock from shareholders. You might go this route for various reasons, such as increasing existing shareholders’ ownership stake or reducing the number of outstanding shares. Another widespread use of retained earnings is investing in other businesses or assets. That said, investing can also lead to profitable returns that you can use to grow your business further. Retained earnings represent a critical component of a company’s overall financial health, as they indicate the profits and losses the company has retained.