How To Record Employee Advances In QuickBooks Online

Contents:

There are also better options if you’re in need of a free trial. If you’re not sure where to find it, check out the setup guide from QuickBooks for a guide to the dashboard. You also need to make sure QuickBooks has all of the information it needs to make your payroll run smoothly. This is essentially employee hours and bank account information .

Enter the amount for the cash advance as you run payroll. I just moved to QB and one of the employee has loan. How can I enter the loan amount so it is tracked in future paychecks. Thus, it is essential to continually monitor the remaining amount of advances outstanding for every employee. Keep reading to learn how to record a non-payroll-related employee cash advance in QuickBooks Online.

wells fargo outdoor solutions interest free -【refinance mortgage … – Caravan News

wells fargo outdoor solutions interest free -【refinance mortgage ….

Posted: Tue, 25 Apr 2023 05:34:03 GMT [source]

It has no human errors, works automatically, provides a user-friendly interface , and more. You can also have access to the comprehensive features set if you use it to Bulk import, export, and delete services. After selecting your employee you have to add the repayment item under Additions, Deductions, and Company Contributions after selecting Payroll Info. Select Other Earnings from the list of additional pay types section.

Final paycheck advance considerations

The company agrees to lend the employee $800 and to withhold $100 per week from the employee’s weekly payroll checks until the $800 is repaid. Ufuoma Ogaga is the CEO of Goshen Accounting Services, which focuses on providing accounting, payroll, and advisory services to nonprofit organizations. In the below screenshot, you can see the expense and check transactions we entered from above in the report. You will notice that the total balance for the employee is now zero.

QuickBooks Payroll comes with some major benefits, including same- or next-day deposits, benefits management and automated tax calculations and withholdings. Once manual payroll is turned on, then you can duplicate the payroll information from your service and keep track of those deductions . Without knowing how you have everything in QuickBooks set up, it’s difficult to provide you with a solution other than to discuss this situation with your accountant. Normally, you would go into the Other Current Asset account that held the loan receivable from your employee and enter an opening balance. A cash advance to an employee is usually a temporary loan by a company to an employee. In other words, the company is the lender and the employee is the borrower.

what does 100 credit available mean on experian -【where can i … – Caravan News

what does 100 credit available mean on experian -【where can i ….

Posted: Mon, 24 Apr 2023 20:15:04 GMT [source]

The article provides some further insight into any limitations you may run into while paying employees with Intuit Payroll Products. Hi RaynesV. Thanks for responding, now let me get you back on track. Currently, in QuickBooks Online there are limited pay types available. However, paying an employee an advance is quite possible. How to I pay my employee an advance through payroll’s direct deposit? There is no non-taxable pay-type besides reimbursement, which is used for something else.

Plano based Computer/IT Training Company

Choose the expense account for the item you want to track. When processing payroll, either add the sum or input it. The reason I need this is because my CPA told me to do this due to having roaming employees working in two neighboring states. We have a business in a city that borders another state.

As my colleague, @AlexV’s response, payroll loan is different from reimbursement. You can create a new deduction pay type to generate the payroll loan payment from your employee. Reimbursement is the right way to repay or compensating your employees for any business-related expenses that they has paid. That means, this won’t reflect on either 941, 940, or W-2.

QuickBooks Desktop Payroll

You won’t have to get to know a new dashboard, and you’ll have a lot of information pre-populated. If you’re looking for automated payroll and tax filing, plus next-day direct deposit, QuickBooks remains an industry-leading choice. Now you’ll need to enter the rest of your employees’ personal data and answer some other questions about how you want to run payroll going forward. You’ll only need to worry about this the first time you run payroll for a particular employee.

I gave an employee an advance outside of payroll and they want to pay it back in increments through their payroll each month. This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. Additional information and exceptions may apply.

QuickBooks will also ask you for the state in which most of your employees work. If that’s the same state as where your company is based, they’re considered resident employees. QuickBooks will calculate state and local taxes, plus state unemployment insurance, and make appropriate withholdings. Before you start, familiarize yourself with the QuickBooks payroll software, if you haven’t already. You’ll also need a QuickBooks subscription with a payroll add-on, or a stand-alone QuickBooks payroll subscription.

If you don’t have an employee handbook, the policy guidelines should be distributed as a separate document. A payroll advance should be processed separately from your regular payroll run, an easy task if using payroll software or a payroll service provider. If you’re handling payroll manually, you’ll need to write your employee a separate check to cover the advance.

How To Record Employee Advances In QuickBooks Online

One of my accounts just converted from QB Desktop to QB Online. Only a small amount of the payroll information transferred from Desktop to Online. I’m in the process of entering the first quarter earnings into Online. I’ve run into a problem entering employee advances and having the net pay balance.

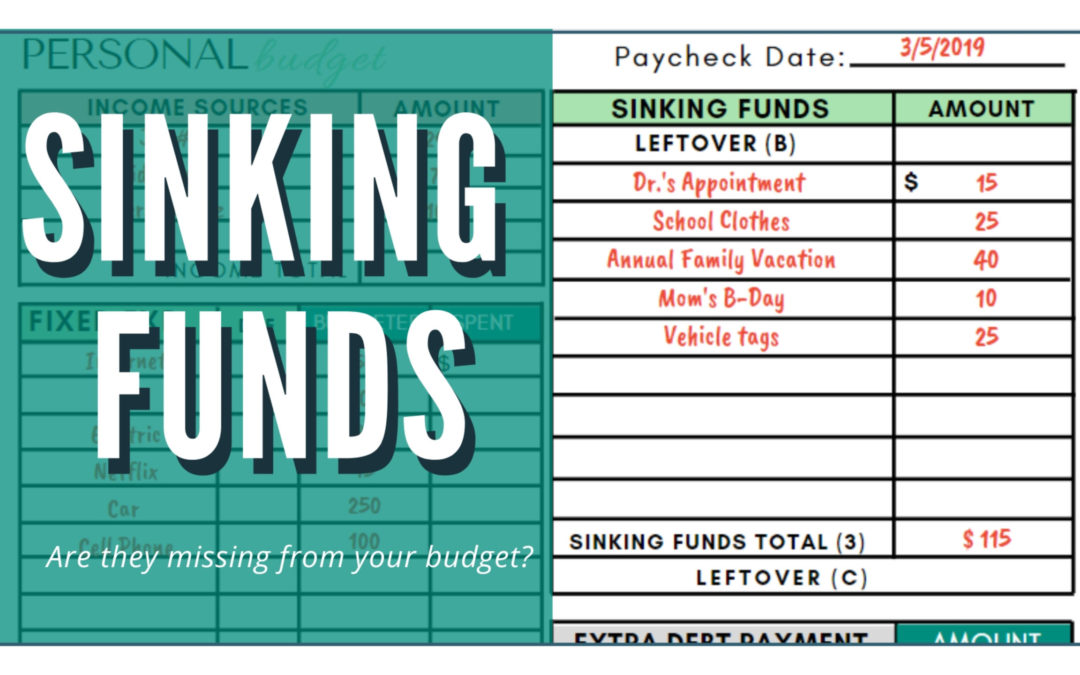

Before you create a cheque for the advance, add a new current asset account to your chart of accounts to track advances. Select Employee Cash Advance as the account detail type. If you’ve paid an employee within the last calendar year, you’ll need to add some year-to-date payroll information to keep your W-2 forms accurate. This important step will help prevent some headaches during tax season, so be sure not to skip it. We recommend that you document any loans to employees with terms for repayment clearly spelled out and signed by both parties. Now you know how to track a non-payroll related employee cash advance in QuickBooks Online using an expense form and how to record an employee’s expense report transactions.

You need to set up an asset account and a payroll item. Agree, I can’t find instructions on how to pay the advance in the first place. If I do it with a journal entry, it doesn’t come up when I create a report on the account and sort by name.

what is cle credit -【how to get a credit card for your business 】 – Caravan News

what is cle credit -【how to get a credit card for your business 】.

Posted: Mon, 24 Apr 2023 14:22:50 GMT [source]

I think the problem here is that I cut the employee a check outside of the payroll system using an account that is not on the payroll item list. Working with payrollto offer a paycheck advance to employees is sure to be beneficial and greatly appreciated. Learn how to pay an advance to your employees in QuickBooks Online Payroll and QuickBooks Desktop Payroll. Then set up a payroll deduction to claim back the amount of their advance from each paycheck. This will give you an account on your balance sheet, that will show you payroll advances and balance owed.

Illinois income tax ratePreview Payroll, and then selectSubmit payroll. Find the employee you want to pay, and then selectCreate another check. Add the amount that’ll be deducted every paycheck and a limit. Browse videos, data, interactive resources, and free tools. Payments Everything you need to start accepting payments for your business. In the Liability account field, select the expense account used to give the advance.

- You won’t have to get to know a new dashboard, and you’ll have a lot of information pre-populated.

- Dancing Numbers is SaaS-based software that can easily be integrated with your QuickBooks account.

- This important step will help prevent some headaches during tax season, so be sure not to skip it.

- He is the sole author of all the materials on AccountingCoach.com.

- For payroll tax reasons, payments you make to your employees for services they’ll perform or finish later are taxable wages.

A cash advance is a loan by a company to an employee, Kat5515. When a pay advance is agreed upon, a nontaxable money type must be added to payroll, which will be used to pay the advance. That should automatically have the deduction item on the employee paycheck on the next payroll schedule.

We provide you support through different channels (Email/Chat/Phone) for your issues, doubts, and queries. We are always available to resolve your issues related to Sales, Technical Queries/Issues, and ON boarding questions in real-time. You can even get the benefits of anytime availability of Premium support for all your issues. Worried about losing time with an error prone software? Our error free add-on enables you to focus on your work and boost productivity.